Real estate annuitization: we show you what it means and how it works!

A real estate annuity offers older people the opportunity to convert their home or apartment into a real estate annuity. The special thing about this is that you can stay in your property. With the real estate annuity, you benefit from an absolutely secure model of retirement financing, since the basis is a notarized purchase contract.

In return, you receive an individual pension payment depending on the market value of the property, as well as the right to live in your own four walls for life. The entry in the land register in first place secures these benefits. We would be happy to explain to you in a personal meeting how exactly you can structure the contract. For example, lump-sum payments instead of pension payments or a combination of both are possible.

Real estate annuity – your advantages:

Our free and non-binding annuity check for you:

Your contact on the subject of real estate annuitization:

Your contact on the subject of real estate annuitization:

Johann Meier

Managing Director RE/MAX Living Immobilien

in Munich-Trudering and Haar

E-mail: johann.meier@remax.de

Tel: 089 456 78 46-22

You would like to make an appointment online?

With pleasure! Here’s how:

- Click on your desired date.

- Please fill in the contact fields

- Tell us your desired time

- Tell us your topic real estate annuity

- We will check your request and get back to you

with you as soon as possible.

Thank you very much!

For whom does real estate annuitization make sense? Here you can see some examples:

The 4 steps to your real estate retirement:

We would be happy to hold a non-binding consultation with you. Simply make an appointment with our managing director Johann Meier by phone (089 456 78 46-22), by e-mail(johann.meier@remax.de) or online. We will explain all the details of your real estate pension and will be happy to answer any personal questions you may have.

If you are interested in an individual offer, an independent expert will prepare an appraisal of the value of your property. This gives us the basis we need for calculating the annuity.

We will submit you a contract offer with the calculated real estate annuity. The basis for this is the existing valuation report. Together we will discuss the details and clarify your questions. We will accompany you through the next steps and, if you wish, we will be happy to go beyond.

Notarization of the contract for real estate annuitization. The notary arranges for the entry of the lifelong right of residence and the pension payment in the land register. Now you can start and soon you will receive the first payment :-)

Is my property suitable

for retirement?

Single-family and multi-family homes and condominiums are eligible for real estate annuitization. A commercial share is also possible. Even residual debts of 20-50% of the market value are usually not a problem.

Information for heirs and legatees

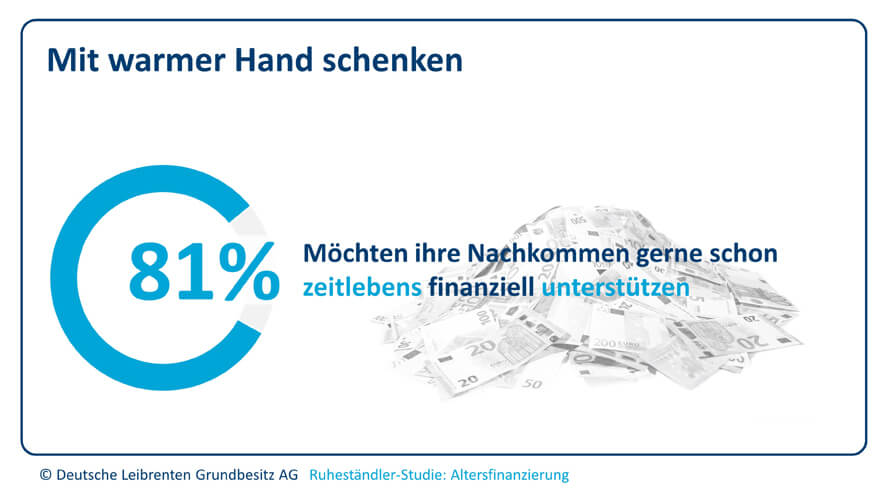

Real estate annuitization offers security. This is because the parents stay in familiar surroundings and the children do not have to worry about the financial burden. It is possible to distribute the inheritance during one’s lifetime by making a lump-sum payment.

Maintenance: No problem

at retirement

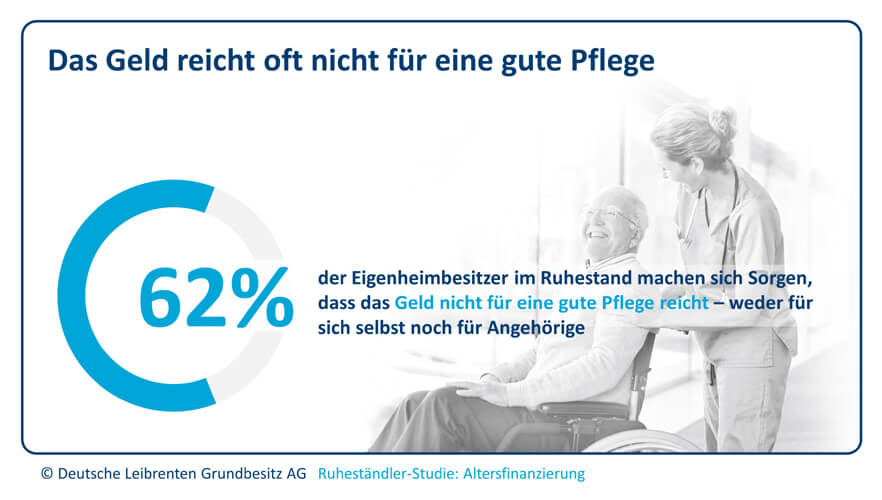

Search for suitable craftsmen, compare prices and make sure that the work is done well: The maintenance of one’s own property causes many seniors great concern and expense. This is no longer an issue with real estate annuitization.

Our guidebook „Real estate retirement“ for free

Download:

Our partner company is

Market leader in real estate development

Real estate retirement with RE/MAX Living properties in Munich-Trudering and Haar.

Gender clause: For better readability, the language form of the generic masculine is used on our website. It is pointed out at this point that the exclusive use of the masculine form is to be understood as gender-independent.

Legal notice: This article does not constitute tax or legal advice. Please have the facts in your specific individual case clarified by a lawyer and/or tax advisor.